Mobile Deposit

Mobile Deposit

How do I enroll in Mobile Deposit?

Mobile Deposit is currently available to qualifying Gold and Silver accounts only. A Mobile Deposit tab will automatically appear within the app of a qualifying account.

How does Mobile Deposit work?

Deposit a check on the go. Quickly & easily deposit checks directly to your accounts using your mobile device.

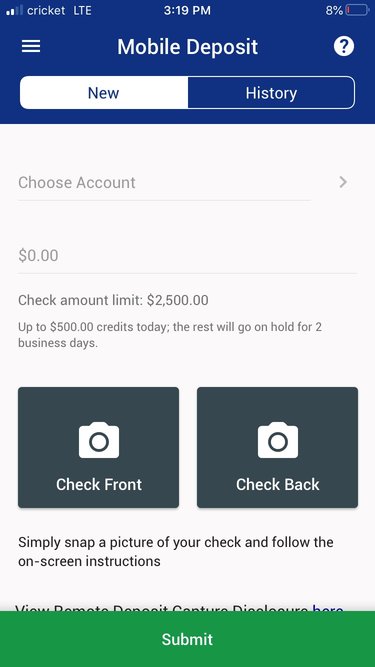

- Choose an account to deposit into.

- Enter the amount of the check. This is used for check validation.

- Select the "Check Front" button and capture the image of the check front. Then capture the image of the check back.

- Review your deposit info and hit the "Submit" button to deposit the check

What is required on the back of the check?

All items transmitted through RDC require a restrictive endorsement which include your signature, NAFCU, your account number and the words “For Mobile Deposit Only”. The credit union has the right to refuse any item that lacks the restrictive endorsement.

Why did part of my check go on hold?

When depositing a check amount higher than $500, $500 will become available immediately and the remaining amount will be placed on a 2 business day hold for your security and the security of the credit union.

Why was my check declined?

You may have reached one of your Mobile Deposit limits. These limits are based on your Northland Member Rewards relationship level.

| Silver 14-20 Points | Gold 21+ Points |

| Daily limit $2,000 or 5 checks | Daily limit $2,500 or 10 checks |

| Rolling 30-day limit $5,000 | Rolling 30-day limit $5,000 |

| Must meet eligibility requirements | Must meet eligibility requirements |

View Member Rewards and Fee Schedule

View Mobile Banking and Remote Deposit Capture Agreement

If you have any further questions, please give us a call. 989-739-1401